Yes, Gusto Payroll is safe. It uses high-level security measures to protect your data.

Payroll management is crucial for any business. Ensuring safety is even more important. Gusto Payroll is a popular choice for small and medium-sized businesses. Many wonder about its safety features. Gusto implements advanced security protocols to safeguard user information. This includes encryption, secure data centers, and regular security audits.

Understanding these measures can help you feel confident in Gusto’s ability to keep your payroll data safe. In this blog post, we’ll explore Gusto Payroll’s security features. This will help you decide if it’s the right payroll solution for your business. Stay with us as we dive into the details.

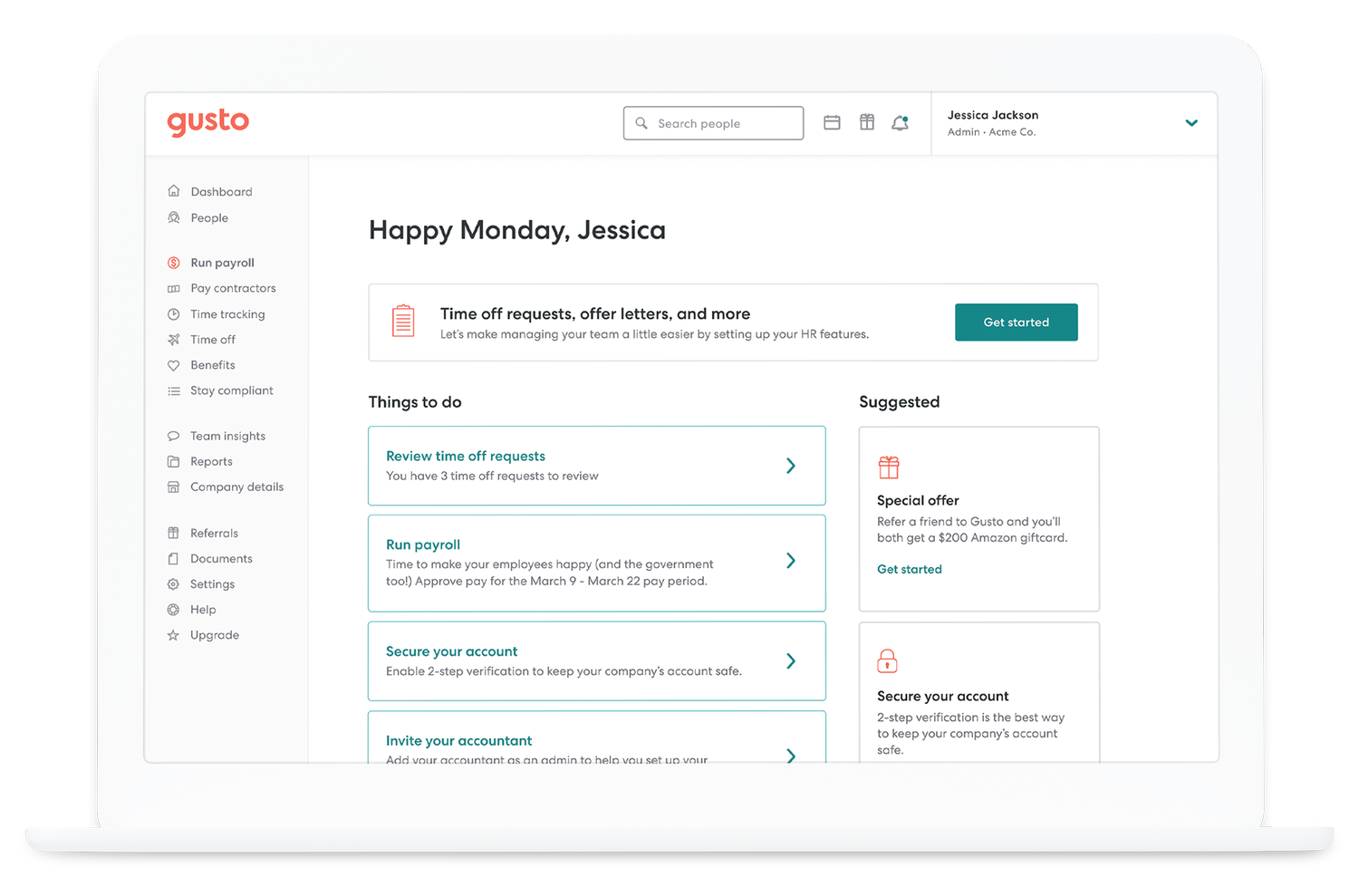

%20(22).png)

Credit: www.levy.company

Gusto Payroll Overview

Gusto Payroll is a popular choice for businesses seeking reliable payroll solutions. Many ask, “Is Gusto Payroll safe?” This blog post explores the safety of Gusto Payroll and provides an overview of its features, benefits, and target users. Understanding Gusto Payroll’s offerings helps businesses make informed decisions about their payroll needs.

Features And Benefits

Gusto Payroll offers a variety of features that cater to businesses’ payroll and HR needs. Here are some key features and benefits:

- Cloud-Based Payroll Services: Access payroll from anywhere, anytime.

- Employee Data Protection: Gusto uses advanced security measures to protect employee data.

- Data Encryption In Payroll: All sensitive information is encrypted to ensure online payroll safety measures.

- Financial Management Tools: Integrated tools help manage benefits, taxes, and compliance.

- Automated Payroll Processing: Simplify payroll with automatic calculations and filings.

Gusto Payroll also provides detailed payroll software reviews and continuous updates to enhance user experience. The platform is designed with user privacy in payroll systems as a priority, ensuring all data is secure and private. Businesses benefit from small business payroll solutions that streamline payroll processing safety and reduce errors. Visit Official Website.

Target Users

Gusto Payroll is suitable for a wide range of users. Here are the main target users:

- Small Businesses: Gusto provides small business payroll solutions that are easy to use and cost-effective.

- Startups: New businesses benefit from Gusto’s comprehensive payroll and HR services.

- Medium-Sized Companies: Medium-sized businesses use Gusto for its scalability and robust features.

- Freelancers: Freelancers and independent contractors can manage their finances with Gusto’s payroll and tax tools.

Gusto’s cloud-based payroll services appeal to businesses seeking flexibility and convenience. The platform’s user-friendly interface and detailed payroll software reviews make it easy for users to navigate and find the features they need. Gusto Payroll security measures, such as data encryption in payroll, ensure that user data remains protected. Additionally, the platform’s online payroll safety measures provide peace of mind for businesses concerned about security and compliance.

Data Security Measures

Is Gusto Payroll safe? This is a common question for businesses considering Gusto Payroll software. Understanding the data security measures in place can help put your mind at ease. Gusto takes data protection seriously, implementing robust security protocols to safeguard confidential information. Let’s delve into some of the key security measures Gusto employs.

Encryption Standards

Gusto employs advanced Encryption Technology to protect sensitive data. Encryption transforms data into a secure format that is unreadable without a decryption key. This ensures that even if data is intercepted, it remains protected.

Here are the key encryption standards Gusto uses:

- AES-256 encryption: This standard is widely regarded as one of the most secure encryption methods available. It is used to encrypt sensitive data at rest and in transit.

- TLS (Transport Layer Security): TLS is used for Secure Data Transmission. It protects data transmitted over the internet by encrypting the connection between the user’s browser and Gusto’s servers.

By implementing these encryption standards, Gusto ensures that your Payroll Software Safety is maintained. This helps in mitigating the risks associated with data breaches and unauthorized access.

Access Controls

Effective User Access Management is crucial for maintaining Employee Data Privacy and overall system security. Gusto has implemented stringent access controls to manage who can access sensitive information within their system.

Here are the key access control measures:

- Role-Based Access Control (RBAC): Users are assigned roles based on their job functions. Each role has specific permissions, ensuring that individuals can only access data relevant to their responsibilities.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security by requiring users to provide two or more verification factors to gain access. This reduces the likelihood of unauthorized access.

- Regular Audits and Monitoring: Gusto conducts regular audits and monitoring of access logs. This helps in identifying and responding to any suspicious activities promptly.

By implementing these access control measures, Gusto ensures robust Risk Management In Payroll. This helps in protecting Confidential Information and maintaining the integrity of the payroll data.

Compliance And Regulations

Is Gusto Payroll Safe? When managing payroll, compliance and regulations are crucial for any business. Gusto Payroll offers a robust solution to ensure your business stays compliant with various laws and regulations. This section will discuss how Gusto handles tax compliance and labor laws to keep your business secure.

Tax Compliance

Gusto Payroll ensures compliance with tax regulations, making it easier for businesses to manage their tax responsibilities. The platform handles various aspects of tax compliance, including:

- Filing federal, state, and local taxes

- Generating W-2 and 1099 forms

- Calculating and withholding payroll taxes

Using Gusto’s tax compliance software, businesses can avoid common mistakes that lead to penalties. The software automatically updates with the latest tax laws, ensuring accurate calculations and filings. This reduces the risk of payroll fraud and errors.

Employee data protection is another vital aspect of Gusto Payroll. The system uses data encryption in payroll processes, safeguarding sensitive information from unauthorized access. The platform also offers payroll processing safety features, such as:

- Two-factor authentication

- Regular security audits

- Secure payroll systems

Here’s a quick overview of Gusto’s tax compliance features:

| Feature | Description |

|---|---|

| Automated Tax Filings | Automatically files federal, state, and local taxes |

| Form Generation | Generates W-2 and 1099 forms for employees and contractors |

| Real-time Updates | Updates software with the latest tax laws |

By using Gusto Payroll, businesses can ensure compliance with tax regulations, protecting them from potential fines and legal issues.

Labor Laws

Compliance with labor laws is essential for avoiding legal complications and ensuring fair treatment of employees. Gusto Payroll helps businesses adhere to labor law requirements through several key features:

- Accurate time tracking

- Overtime calculation

- Benefits management

Accurate time tracking ensures employees are paid for their actual hours worked. Gusto’s system keeps records that comply with labor law requirements. This reduces the risk of disputes and helps in payroll fraud prevention.

Overtime calculation is another critical aspect of labor law adherence. Gusto’s payroll software reviews working hours and calculates overtime pay based on current laws. This ensures employees receive fair compensation for extra hours worked.

Benefits management is also streamlined with Gusto Payroll. The platform handles various benefits, including health insurance, retirement plans, and paid time off. This simplifies compliance with labor laws related to employee benefits.

Gusto Payroll security measures further ensure labor law adherence. The system uses data encryption in payroll processes to protect employee information. Regular security audits and two-factor authentication enhance the platform’s security.

Here’s a summary of Gusto’s labor law compliance features:

| Feature | Description |

|---|---|

| Time Tracking | Accurately records employee hours |

| Overtime Calculation | Calculates overtime pay based on current laws |

| Benefits Management | Manages health insurance, retirement plans, and paid time off |

Using Gusto Payroll helps businesses stay compliant with labor laws, ensuring fair treatment of employees and avoiding legal issues.

Credit: peoplemanagingpeople.com

User Reviews And Experiences

Is Gusto Payroll Safe? This question is often asked by businesses considering this payroll service. User reviews and experiences provide valuable insights into the safety and reliability of Gusto Payroll. This section explores what users are saying about their experiences with Gusto, highlighting both positive feedback and common concerns.

Positive Feedback

Many users have shared positive Gusto User Experiences, praising various aspects of the service. Here are some key points:

- Employee Data Protection: Users appreciate Gusto’s commitment to keeping their data secure. Gusto employs robust Data Encryption Practices to ensure sensitive information is protected.

- Ease of Use: The platform is user-friendly, making payroll processing a breeze for many businesses. This ease of use is frequently mentioned in Payroll Software Reviews.

- Customer Support Reliability: Gusto’s customer support team is often praised for their responsiveness and helpfulness. Users report that issues are resolved quickly and efficiently.

Additionally, many users find that Gusto’s Tax Compliance Measures are thorough and reliable. This ensures that businesses remain compliant with tax regulations without having to worry about errors or oversights.

| Feature | Positive Feedback |

|---|---|

| Data Protection | Strong encryption and user privacy policies |

| Ease of Use | Intuitive and user-friendly interface |

| Customer Support | Responsive and reliable assistance |

| Tax Compliance | Accurate and reliable tax measures |

Common Concerns

Despite the positive feedback, some users have raised concerns about Gusto Payroll. Here are a few common issues:

- Payroll System Vulnerabilities: While Gusto employs strong security measures, some users worry about potential Payroll System Vulnerabilities. They seek reassurance that their data remains secure.

- Customer Support Delays: Although many users praise customer support, a few have experienced delays. These users feel that support response times could be improved.

- Pricing: Some users find Gusto’s pricing higher than other payroll services. They question whether the benefits justify the cost.

Another concern is related to the Payroll Processing Safety. A small number of users have reported occasional glitches or delays in payroll processing, which can be frustrating for businesses relying on timely payments.

In summary, Gusto Payroll Security is generally well-regarded, but like any service, it has areas for improvement. By understanding both the positive feedback and common concerns, businesses can make an informed decision about using Gusto Payroll.

Customer Support Services

Gusto Payroll is known for its robust payroll software safety, ensuring user privacy and employee data security. One of the critical aspects that contribute to Gusto Payroll’s reliability is its outstanding customer support services. These services are designed to assist users in navigating the software and resolving issues promptly, which ultimately enhances payroll compliance and software reliability. Let’s delve into the various customer support options offered by Gusto Payroll.

Support Channels

Gusto Payroll provides multiple customer support channels to ensure that users can get help when they need it. These channels are designed to cater to various preferences and needs, making it easier for users to find solutions to their issues. Here are some of the primary support channels:

- Email Support: Users can send an email describing their issue. A support representative will respond with a solution or further questions.

- Phone Support: For more immediate assistance, users can call Gusto’s support team. This is ideal for urgent issues that require quick resolution.

- Live Chat: The live chat option allows users to have real-time conversations with a support representative directly through the Gusto website.

- Help Center: Gusto offers an extensive online help center with articles, guides, and FAQs to help users find answers independently.

- Community Forum: Users can engage with other Gusto users in the community forum to share experiences and solutions.

These support channels ensure that users have various ways to seek help, enhancing the overall user experience. By providing multiple options, Gusto Payroll ensures that users can choose the most convenient and effective way to address their concerns.

Response Times

Response time efficiency is crucial for online payroll services, especially when dealing with sensitive data protection measures. Gusto Payroll understands this and prioritizes quick and effective responses to user inquiries. Here’s a closer look at the expected response times for each support channel:

| Support Channel | Expected Response Time |

|---|---|

| Email Support | Within 24 hours |

| Phone Support | Immediate (during business hours) |

| Live Chat | Immediate (during business hours) |

| Help Center | Instant (self-service) |

| Community Forum | Varies (peer support) |

Phone and live chat support offer immediate assistance during business hours, making them the best options for urgent issues. Email support typically responds within 24 hours, providing a reliable alternative for less urgent inquiries. The help center and community forum offer self-service options, which can be helpful for users who prefer to find answers independently.

By maintaining efficient response times across all support channels, Gusto Payroll ensures that users can get the help they need without significant delays. This commitment to customer support reinforces Gusto Payroll’s dedication to maintaining high standards of payroll software safety and employee data security.

Alternatives To Gusto

Gusto Payroll is known for its user-friendly interface and comprehensive services. But, you might wonder, is Gusto Payroll safe? And, are there alternatives to Gusto that offer similar or even better features? Let’s explore some alternatives to Gusto to help you make an informed decision.

Comparison With Competitors

When evaluating alternatives to Gusto, it’s crucial to consider how Gusto compares with its competitors. Several key players in the payroll software market provide robust features and security:

- Paychex: Known for its extensive payroll and HR services. Paychex offers strong Payroll Compliance and Employee Data Security. Gusto Vs Paychex often comes down to the scale and specific needs of your business.

- ADP: A giant in payroll services, ADP provides comprehensive solutions for businesses of all sizes. Their Payroll Software Safety measures are top-notch.

- QuickBooks Payroll: Integrated with QuickBooks accounting software, this system is ideal for businesses already using QuickBooks. It offers reliable payroll services and Cloud-Based Payroll Solutions.

To make it easier, here’s a quick comparison table:

| Feature | Gusto | Paychex | ADP | QuickBooks Payroll |

|---|---|---|---|---|

| Payroll Compliance | Yes | Yes | Yes | Yes |

| Employee Data Security | High | High | High | High |

| Cloud-Based | Yes | Yes | Yes | Yes |

| Customer Reviews | 4.5/5 | 4.0/5 | 4.2/5 | 4.3/5 |

Each of these Competitor Payroll Systems offers robust solutions. Your choice depends on your specific needs and preferences.

Choosing The Right Option

Choosing the right payroll software involves evaluating several factors. Here are some key considerations:

- Business Size: Small businesses might find Gusto’s simplicity appealing. Larger enterprises might prefer ADP’s extensive features.

- Integration Needs: If you use QuickBooks for accounting, QuickBooks Payroll offers seamless integration.

- Data Protection In Payroll: Ensure the software has strong security measures. Employee Data Security should be a top priority.

- Customer Support: Reliable customer support is essential. Check Gusto Reviews and reviews of other systems to gauge their support quality.

- Cost: Compare the pricing plans of different systems. Some may offer better value for your specific needs.

Cloud-Based Payroll Solutions offer flexibility and ease of access. But, you must ensure Payroll Service Reliability. Gusto Payroll Security is robust, but you should assess the security features of other systems too.

In summary, each payroll system has its strengths. Whether it’s Gusto, Paychex, ADP, or QuickBooks Payroll, ensure it meets your specific requirements. Evaluate the features, security, and reviews before making a decision.

Cost Analysis

Gusto Payroll is a popular choice for businesses seeking reliable payroll services. Many ask, “Is Gusto Payroll safe?” To answer this, a cost analysis is essential. This will help understand if the pricing aligns with the value provided, considering the Employee Data Protection and Payroll Software Security features included.

Pricing Plans

Gusto offers multiple pricing plans to suit different business needs. Below are the main plans:

- Core: $39 per month plus $6 per employee

- Complete: $39 per month plus $12 per employee

- Concierge: $149 per month plus $12 per employee

- Select: Custom pricing for larger businesses

The Core plan includes basic features like full-service payroll, Payroll Compliance, Cloud-Based Payroll Systems, and Online Payroll Safety. The Complete plan adds advanced features like time tracking, project tracking, and next-day direct deposits. The Concierge plan includes everything in the Complete plan plus dedicated support and HR resource center. The Select plan is tailored for larger businesses with more specific needs.

Each plan aims to provide a balance between cost and essential features. For small businesses, the Core plan may be sufficient. Larger businesses may find value in the Complete or Concierge plans due to the additional support and features.

Value For Money

Evaluating the value for money involves looking at the features each plan offers. The Core plan, at $39 per month plus $6 per employee, provides essential services such as:

- Full-service payroll

- Employee self-service

- Data Encryption

- Payroll Service Reliability

The Complete plan, at $39 per month plus $12 per employee, includes additional features:

- Time tracking

- Project tracking

- Next-day direct deposits

The Concierge plan, at $149 per month plus $12 per employee, offers premium features:

- Dedicated support

- HR resource center

- Advanced compliance help

Gusto Payroll Reviews often highlight the Gusto Features that enhance Payroll Software Security and Payroll Compliance. Businesses value Gusto Payroll Security measures like Data Encryption. Reviews suggest that the higher the plan, the better the support and additional features, which are crucial for larger businesses.

Overall, Gusto’s pricing structure is designed to cater to various business sizes and needs, ensuring Payroll Service Reliability and Employee Data Protection at each level.

Final Thoughts

When considering payroll solutions, the safety and security of your data are crucial. Gusto Payroll is a popular choice for many businesses due to its user-friendly interface and comprehensive features. But is Gusto Payroll safe? Let’s delve into the final thoughts on this topic.

Key Takeaways

Gusto Payroll has made significant strides in ensuring the safety and security of its users’ data. Here are some key takeaways:

- Cybersecurity Measures: Gusto implements advanced cybersecurity measures to protect user data from potential threats.

- User Data Privacy: The company is committed to maintaining user data privacy, ensuring that sensitive information is protected at all times.

- Payroll Software Safety: Gusto’s software is designed with multiple layers of security to prevent unauthorized access and data breaches.

- Data Protection: With robust data protection protocols, Gusto ensures that employee information and financial data are securely stored and processed.

- Employee Information Security: The platform uses encryption and secure data storage to safeguard employee information.

- Financial Software Reliability: Gusto’s reliability in handling financial transactions and payroll processing is well-regarded in the industry.

In summary, Gusto Payroll prioritizes security and reliability, making it a trustworthy choice for businesses of all sizes.

Recommendations

Based on the insights gathered, here are some recommendations for using Gusto Payroll:

- Regularly Update Passwords: Ensure that you update your passwords regularly and use strong, unique passwords for added security.

- Enable Two-Factor Authentication (2FA): Activate 2FA on your Gusto account to add an extra layer of security during login.

- Stay Informed: Keep up-to-date with Gusto User Reviews and any updates or changes to the platform’s security features.

- Utilize Cloud-Based Payroll Features: Take advantage of Gusto’s cloud-based payroll features for real-time access and secure data management.

- Educate Employees: Ensure that employees are aware of the importance of data security and follow best practices when handling sensitive information.

- Monitor Account Activity: Regularly monitor your account activity to detect any unusual behavior or potential security threats.

By following these recommendations, businesses can enhance their payroll processing safety and ensure that their data remains secure with Gusto Payroll.

Credit: gusto.com

Frequently Asked Questions

What Is Gusto Payroll?

Gusto Payroll is an online payroll service. It helps businesses manage employee payments. It also offers benefits administration and HR tools.

Is Gusto Payroll Secure?

Yes, Gusto Payroll is secure. It uses advanced security measures. These include data encryption and secure servers to protect your information.

How Does Gusto Protect Data?

Gusto protects data with encryption. They use secure servers and regular security audits. This ensures your data remains safe.

Can Gusto Handle Tax Filings?

Yes, Gusto handles tax filings. It calculates, files, and pays your payroll taxes. This simplifies the payroll process for businesses.

Conclusion

Gusto Payroll offers a safe and reliable solution for managing payroll. Its security features protect your sensitive information. The user-friendly interface ensures ease of use. Many businesses trust Gusto for their payroll needs. This shows Gusto’s commitment to safety and efficiency.

Choosing Gusto can bring peace of mind. So, consider Gusto Payroll for a secure payroll experience.