Managing finances can be tough for small businesses. Many owners feel overwhelmed by accounting tasks.

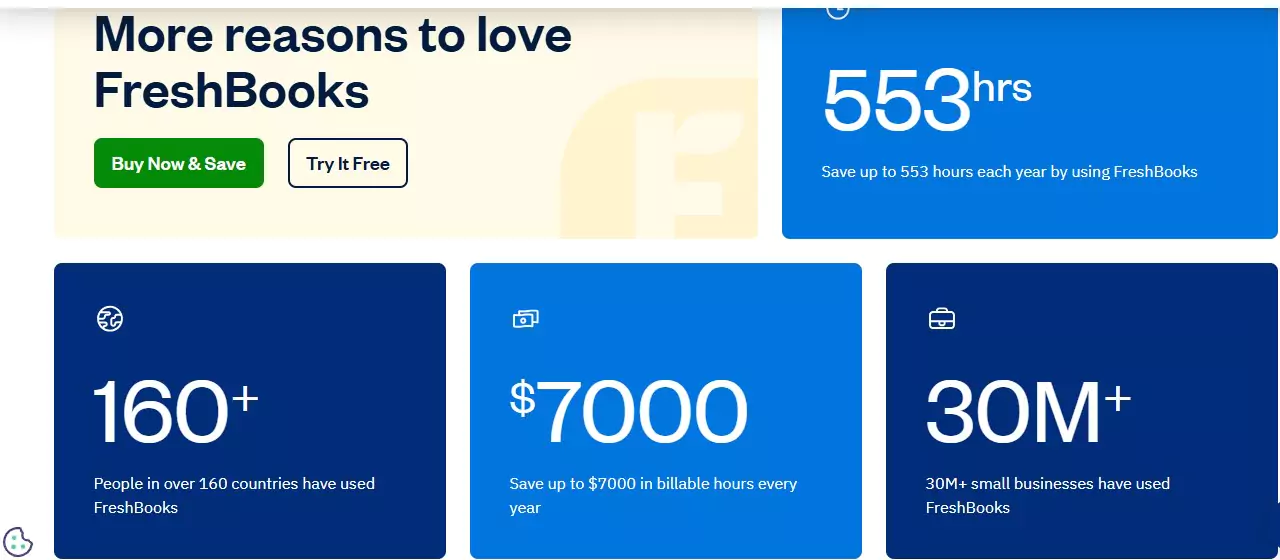

FreshBooks offers a solution to simplify this process. This financial software is designed with small businesses in mind. It helps track expenses, send invoices, and manage payments easily. With its user-friendly interface, business owners can focus on what they do best—growing their companies.

FreshBooks provides essential tools that save time and reduce stress. Many small business owners appreciate its ability to streamline accounting tasks. This software not only helps manage finances but also offers insights to improve cash flow. Understanding how FreshBooks can support your business can lead to smarter financial decisions. Let’s explore its features and benefits that make it a top choice for small business owners.

Introduction To FreshBooks

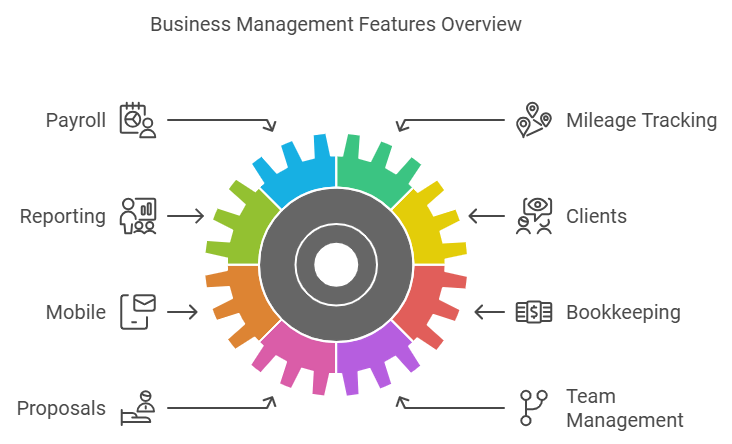

FreshBooks is a popular financial software designed specifically for small businesses. It simplifies many aspects of financial management. From invoicing to bookkeeping, FreshBooks provides tools that help small business owners manage their finances easily. This section introduces what FreshBooks is and its key features.

What Is FreshBooks?

FreshBooks is an accounting software tailored for small businesses. It focuses on making financial management simple and efficient. Users can handle tasks like invoicing, expense tracking, and cash flow management all in one place. This cloud accounting solution allows business owners to access their financial data from anywhere.

Some important aspects of FreshBooks include:

- Online invoicing that is easy to set up and send.

- Expense tracking to monitor spending.

- Cash flow management to keep finances healthy.

- Tax preparation assistance to simplify filing.

- Reporting tools for understanding business performance.

FreshBooks is designed for non-accountants. Its user-friendly interface makes it accessible for everyone. The software helps small business owners focus on their work, not on complicated accounting tasks.

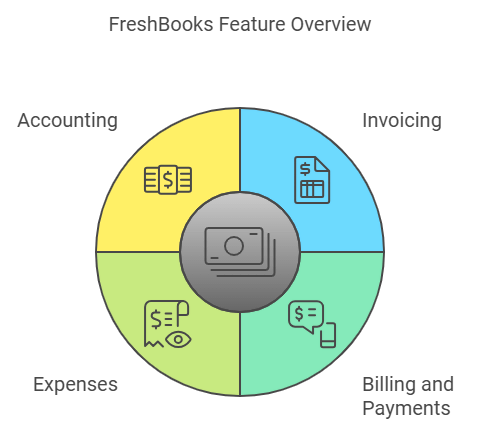

Key Features

FreshBooks offers a variety of features that benefit small businesses. Here are some key features:

| Feature | Description |

|---|---|

| Online Invoicing | Create and send invoices quickly. Clients can pay online. |

| Expense Tracking | Easily track expenses by uploading receipts. |

| Cash Flow Management | Monitor cash flow with real-time updates. |

| Tax Preparation | Organize expenses for easier tax preparation. |

| Reporting Tools | Generate reports to analyze financial performance. |

These features help streamline the bookkeeping process. FreshBooks can adapt to the needs of any small business. It supports better financial decisions and keeps everything organized. This ensures that business owners can focus on growth and success.

Benefits For Small Businesses

FreshBooks offers financial software tailored for small businesses. It provides essential tools for managing finances effectively. Small businesses can benefit significantly from its features, making financial tasks easier. FreshBooks helps with billing, accounting, and online invoicing. The software focuses on simplifying financial management. This leads to better profitability tracking and overall business health.

Time-saving Solutions

FreshBooks delivers time-saving solutions that help small businesses manage their finances efficiently. With its user-friendly interface, users can quickly navigate through the software. This reduces the time spent on financial tasks. Here are some features that save time:

- Automated Invoicing: Create and send invoices automatically.

- Recurring Billing: Set up recurring payments for regular clients.

- Time Tracking Tools: Track time spent on projects directly within the software.

- Expense Tracking: Easily record expenses with mobile receipt scanning.

These features streamline daily tasks. Business owners can focus more on growth and less on paperwork. A comparison table shows how FreshBooks saves time compared to traditional methods:

| Task | Traditional Method | FreshBooks |

|---|---|---|

| Creating Invoices | Manual creation | Automated creation |

| Tracking Time | Pencil and paper | Built-in tracking |

| Expense Management | Spreadsheets | Mobile scanning |

Less time on finances means more time for clients. FreshBooks is a smart choice for small business finance.

Cost-effective Options

FreshBooks offers cost-effective options for small businesses. Many small businesses operate on tight budgets. Using affordable financial software can lead to significant savings. FreshBooks provides several pricing plans to fit different needs. Here is how it can save money:

- Affordable Plans: Various plans ensure you pay only for what you need.

- No Hidden Fees: Transparent pricing with no surprises.

- Invoicing Solutions: Reduce costs associated with paper invoicing.

Many small businesses may not have a full-time accountant. FreshBooks serves as a reliable accounting software option. It can replace some accounting services, saving money. Below is a cost comparison:

| Service | Cost with Accountant | Cost with FreshBooks |

|---|---|---|

| Monthly Accounting Fees | $300 | $15 – $50 |

| Invoicing Costs | $100 (paper invoices) | Free (online invoicing) |

These savings add up quickly. FreshBooks not only simplifies tasks but also keeps costs low.

Invoicing Made Easy

FreshBooks is a top choice for small business finance. It simplifies financial management through its easy-to-use features. One of the standout features is invoicing. Invoicing made easy means less time spent on paperwork and more time for your business. FreshBooks helps you create and send invoices quickly. It also tracks payments and expenses, making it a powerful accounting software for small businesses.

Customizable Invoices

Customizing invoices is vital for any business. FreshBooks allows you to create invoices that reflect your brand. You can choose colors, fonts, and logos to match your business identity. This personalization helps to build trust with clients.

Here are some key features of FreshBooks’ customizable invoices:

- Branding options: Add your logo and color scheme.

- Templates: Use pre-made templates or create your own.

- Line items: Easily add products or services with descriptions.

- Discounts: Apply discounts directly on the invoice.

FreshBooks also provides a simple table for invoicing:

| Invoice Feature | Description |

|---|---|

| Customization | Change colors, fonts, and add your logo. |

| Recurring Invoices | Set up invoices to send automatically. |

| Payment Options | Include various payment methods for clients. |

With FreshBooks, you can create invoices in minutes. This invoicing software helps manage your business expenses effectively. Clear and professional invoices lead to faster payments and happier clients.

Automated Billing

Automated billing is a huge benefit for small businesses. FreshBooks offers tools that make billing easier. You can set up recurring billing for clients. This means invoices are sent automatically on a schedule you choose. It saves time and reduces mistakes.

Here’s how automated billing helps:

- Saves time: Less manual work on invoices.

- Consistency: Clients receive invoices on time.

- Payment reminders: Automatic reminders for unpaid invoices.

FreshBooks makes payment processing simple. Here is a quick overview of its automated billing features:

| Billing Feature | Benefit |

|---|---|

| Recurring Payments | Set it once and forget it. |

| Payment Links | Clients can pay directly from invoices. |

| Reports | Track income and expenses easily. |

With automated billing, your business runs smoothly. It helps maintain cash flow. FreshBooks ensures you get paid on time, every time. Spend less time on billing and more time on growing your business.

Expense Tracking

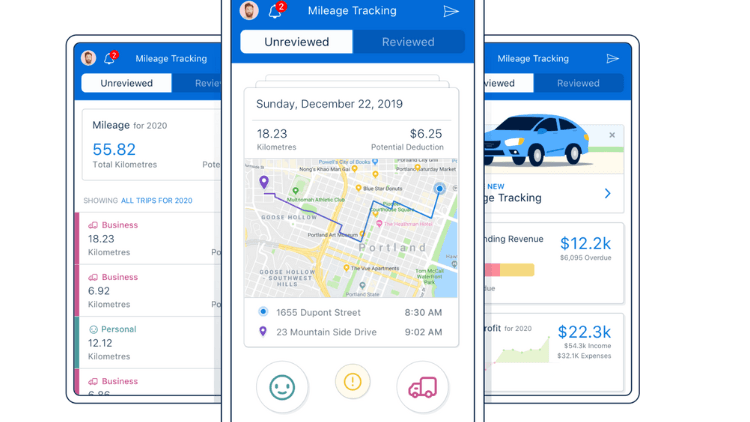

FreshBooks is a powerful financial software designed for small businesses. One of its standout features is Expense Tracking. This tool simplifies how businesses manage their expenses. Tracking expenses can be a daunting task, especially for small business owners. FreshBooks makes it easier to keep all financial data organized. This helps in financial reporting, tax preparation, and overall financial management.

Receipt Scanning

Receipt scanning is a key feature in FreshBooks. This tool allows users to quickly digitize their paper receipts. Simply take a photo of your receipt with your smartphone. FreshBooks automatically extracts the important information. This saves time and reduces human error in data entry.

Here are some benefits of using receipt scanning:

- Quickly capture and store receipts.

- Reduce clutter from physical receipts.

- Store receipts securely in the cloud.

- Easy access to receipts during tax season.

FreshBooks makes receipt management user-friendly. Users can categorize receipts easily. This helps keep expense tracking accurate and organized. The software allows you to create a digital filing system.

Here’s a simple table showing how receipt scanning works:

| Step | Action | Result |

|---|---|---|

| 1 | Take a photo of your receipt | Capture all details instantly |

| 2 | Upload to FreshBooks | Receipt is saved in the cloud |

| 3 | Organize by category | Easy expense tracking |

Categorizing Expenses

Categorizing expenses is vital for effective financial management. FreshBooks allows users to group expenses into specific categories. This helps small business owners understand where their money goes.

Users can create custom categories based on their needs. Here are some common categories:

- Office Supplies

- Travel Expenses

- Utilities

- Marketing Costs

Benefits of categorizing expenses include:

- Better tracking of spending habits.

- Improved budget management.

- Streamlined tax preparation.

- Enhanced financial reporting.

FreshBooks offers visual reports to show categorized expenses. Users can see a clear picture of their finances. This feature assists in making informed business decisions. It simplifies bookkeeping solutions for small business accounting.

Utilizing expense tracking and receipt management in FreshBooks enhances financial oversight. Small business owners can focus on growth while keeping a close eye on their expenses.

Reporting Tools

FreshBooks is a powerful financial software designed for small businesses. It simplifies many accounting tasks, especially reporting tools. These tools help you understand your business’s financial health. Good reporting helps in decision-making. FreshBooks offers easy ways to create important financial reports, saving time and effort.

Profit And Loss Statements

The Profit and Loss (P&L) statement is essential for any small business. It shows your income and expenses over a specific period. This report helps you track profit and loss accurately. FreshBooks makes creating P&L statements simple.

With FreshBooks, you can:

- Quickly generate reports with just a few clicks.

- Understand your revenue streams.

- Identify high and low expense areas.

Here are some key components of a Profit and Loss statement:

| Component | Description |

|---|---|

| Revenue | Your total income from sales or services. |

| Cost of Goods Sold | Direct costs tied to the production of goods or services. |

| Gross Profit | Revenue minus Cost of Goods Sold. |

| Operating Expenses | Costs needed to run your business, like rent and utilities. |

| Net Profit | Gross Profit minus Operating Expenses. |

Using FreshBooks for profit tracking is effective. You can analyze trends and make informed decisions. This helps in budgeting tools and cash flow management.

Tax Reports

Tax reports are crucial for small business owners. They ensure you meet tax obligations correctly and on time. FreshBooks offers tools that simplify tax preparation.

Key benefits of using FreshBooks for tax reports include:

- Organized financial data for easy access.

- Automatic calculations for accurate reporting.

- Clear summaries of income and expenses for tax time.

The software helps in generating specific tax reports:

| Report Type | Description |

|---|---|

| Income Reports | Shows total earnings for the year. |

| Expense Reports | Details all business-related expenses. |

| Sales Tax Reports | Calculates sales tax collected from customers. |

These reports make tax season less stressful. FreshBooks’ online payment processing and invoicing software also help track payments. This ensures accurate records for tax filings.

Integrations

FreshBooks is a powerful financial software designed for small businesses. It offers various features that simplify financial management. One key aspect of FreshBooks is its ability to integrate with other tools. These integrations enhance its capabilities, making it a comprehensive solution for small business finance. Users can connect FreshBooks with different software to streamline tasks, improve efficiency, and make better business financial reports.

Compatible Software

FreshBooks works seamlessly with many popular software programs. This compatibility allows users to enhance their workflows. Here are some key software that integrates with FreshBooks:

- Tax Preparation Software: Easily import data for tax filing.

- Invoicing Software: Simplify your invoicing process.

- Online Payment Processing: Accept payments faster and securely.

- Accounting Solutions: Synchronize your financial data easily.

- Cloud Accounting: Access your financial data from anywhere.

These integrations improve overall financial management. They help small businesses save time and reduce errors. Here’s a table showcasing some compatible software with FreshBooks:

| Software Type | Integration Benefit |

|---|---|

| Tax Preparation Software | Streamlined data import for tax filings |

| Invoicing Software | Faster invoicing and payment tracking |

| Online Payment Processing | Quick and secure payment acceptance |

| Accounting Solutions | Synchronized financial data for accuracy |

| Cloud Accounting | Access to financial data anytime, anywhere |

These compatible software options enhance FreshBooks for small business owners. They create a robust ecosystem for managing finances.

Third-party Applications

FreshBooks also supports various third-party applications. These applications add extra features and functionality. They help with tasks like expense tracking and bookkeeping. Users can choose from a wide range of options. Here are some popular third-party applications that work well with FreshBooks:

- Expense Tracking Tools: Keep track of all your expenses easily.

- Financial Management Tools: Gain insights into your financial health.

- Project Management Software: Track project costs and time.

- CRM Tools: Manage customer relationships effectively.

- Payment Gateways: Enhance payment options for clients.

These applications improve the user experience with FreshBooks. They offer additional features that cater to specific business needs. Here’s a quick list of some notable third-party applications:

- Expensify – for expense management

- Trello – for project management

- Stripe – for online payment processing

- Salesforce – for customer relationship management

Integrating these third-party applications makes FreshBooks a more powerful tool. Small business owners can customize their financial management solutions to fit their unique needs.

Pricing Plans

FreshBooks is a powerful financial software designed for small businesses. It simplifies managing small business finances. With various pricing plans, users can choose what fits their needs best. Whether you want simple invoicing solutions or comprehensive financial management tools, FreshBooks has you covered. Understanding the pricing plans helps you make informed decisions for your business.

Monthly Subscriptions

FreshBooks offers several monthly subscription plans. Each plan is tailored to meet different business needs. Here is a quick overview:

| Plan | Monthly Cost | Features |

|---|---|---|

| Lite | $15 |

|

| Plus | $25 |

|

| Premium | $50 |

|

Each plan includes essential features. These features help with bookkeeping software and accounting software tasks. Subscription billing and expense tracking tools make managing your finances easier. Choose a plan that meets your current business size and goals.

Free Trial Options

FreshBooks offers a free trial for new users. This trial lasts for 30 days. It allows you to test all features without any cost. You can explore invoicing solutions, online payment processing, and cloud-based accounting tools.

During the trial, you can:

- Set up your account easily.

- Create and send invoices.

- Track expenses effortlessly.

- Manage client information securely.

The free trial gives you a chance to see how FreshBooks fits your business needs. You can experience the user-friendly interface and the powerful financial management tools. After the trial, you can decide which monthly subscription suits you best.

Frequently Asked Questions

What Is FreshBooks Software For Small Businesses?

FreshBooks is a cloud-based financial software designed for small businesses. It simplifies invoicing, expense tracking, and time management. Users can automate billing and gain insights into their finances. This makes it easier to manage cash flow and improve overall productivity.

How Does FreshBooks Help With Invoicing?

FreshBooks offers customizable invoicing templates that streamline the billing process. Users can create and send invoices quickly, track payments, and set up automated reminders. This functionality helps ensure timely payments from clients, enhancing cash flow and reducing administrative workload for small businesses.

Is FreshBooks User-friendly For Beginners?

Yes, FreshBooks is designed with user-friendliness in mind. Its intuitive interface allows beginners to navigate easily without extensive training. The platform offers helpful tutorials and customer support to assist new users. This makes it accessible for small business owners with varying technical skills.

Can FreshBooks Integrate With Other Tools?

FreshBooks integrates seamlessly with various third-party applications. Popular integrations include payment processors, CRM tools, and e-commerce platforms. This connectivity enhances its functionality and allows users to streamline their workflows. Small businesses benefit from a more cohesive management system through these integrations.

Conclusion

FreshBooks is a strong choice for small businesses. It simplifies accounting and invoicing tasks. Users appreciate its easy-to-use interface. You can manage finances without stress. Tracking expenses becomes quick and simple. Customer support is friendly and helpful. Small business owners can save time and focus on growth.

Choosing the right software is essential. FreshBooks offers a good solution for financial management. This software can help your business succeed. Consider trying FreshBooks for your accounting needs.